Negative Interest Rates

What's all this then, why would I as a consumer ever want negative interest rates? Short answer: you don't.

What's all this then, why would I as a consumer ever want negative interest rates? Short answer: you don't.The idea of negative interest rates is counterintuitive to say the least, so here's what I hope to be a little clarity. This concept is playing an increasing role in the banking/financial systems. I will have a bias towards the Austrian Econ point of view so I also included a variety of sources outside the Austrian sphere.

The information contained within this post speaks to the financial and monetary systems as they stand today, but necessarily as they should be, particularly anything surrounding interest. Clearly we can see that the status quo is not working the greatest for those of us who are not directly involved…and there certainly are a lot of us who are not.

To be sure, a good portion of the population will have some indirect involvement in the form of savings and retirement investments, but like the financial/monetary systems themselves, there are better ways to skin the proverbial four-legged-feline-mammal-that-shall-not-be-mentioned.

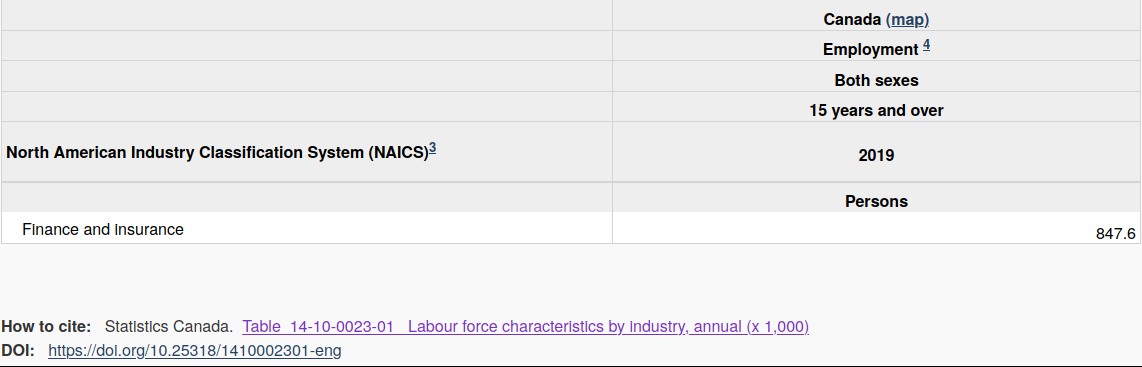

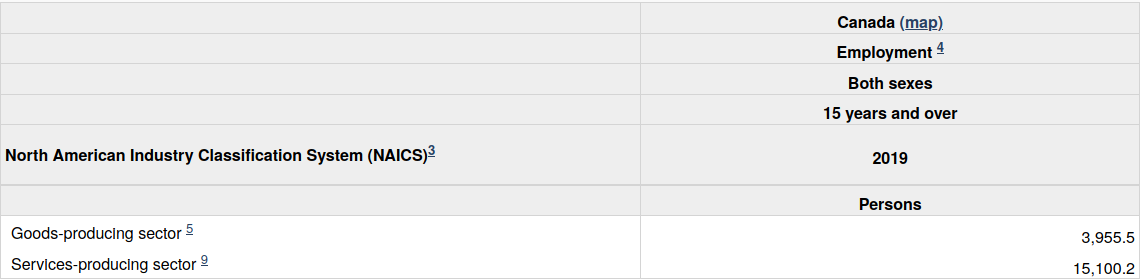

Labour force characteristics by industry - Statistics Canada said

Canadians working in the financial Sector - 847,600

All sectors, finance removed - 19,055,700

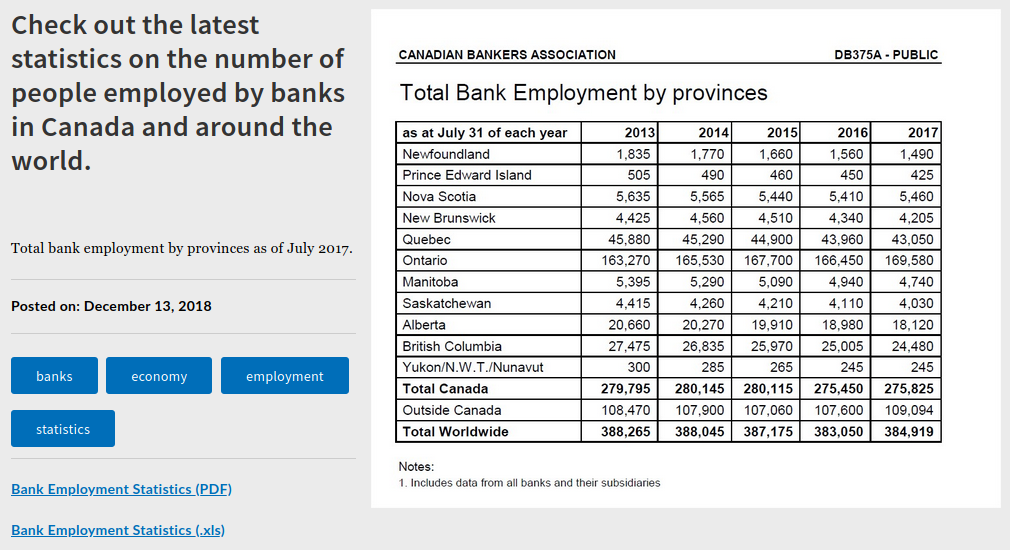

Canadian Bankers Association said

So, besides the obvious, what is really meant exactly when referring to negative interest rates. Let's start with the straight up dictionary definition to get the ball rolling:

Clear as mud, onward and upward…Cambridge Business English Dictionary © Cambridge University Press said

The Plain Bagel said

Keeping in mind that the entire idea of negative interest rates is mindbogglingly silly and therefore so are the specifics, from a general perspective, this one is an easy to digest overview as well as solid explanation of the major pitfalls of negative interest rates.

How Negative Interest Rates Work (And What They Would Mean for the Economy)

yahoo! finance said

Another general overview.

Negative interest rates: How they work and what they mean for banks and investors

CNBC said

This one is a little more specific in some areas and as such, perhaps consider it a little more of an advanced nature.

What Would Negative Interest Rates Mean For Consumers And The Economy?

Negative interest on excess reserves - WikipediaMainstream Media said

Mises.org said

"We are repeatedly told that the unprecedented monetary stimulus by the Federal Reserve and other central banks is necessary to stimulate the economy, create jobs, and generate economic growth. The truth is that this scheme is designed to stealthily steal from the productive classes in order to enrich the unproductive financial class and the counterproductive political classes. It is a con game."

Negative Interest Rates and Financial Repression - Mark Thornton"Those who had hoped that things could not get worse with the monetary policy of the European Central Bank (ECB) have been proven wrong. At its last meeting on 25 July 2019, the Governing Council of the ECB kept interest rates unchanged: the main refinancing rate was kept at 0.00% and the deposit rate at -0.40%. At the same time, however, ECB President Mario Draghi has prepared the ground to lower interest rates even further in the coming months. What is the reasoning behind that?

According to the ECB Governing Council, inflation is too low, and the euro area economy is too weak. It was precisely this assessment that signaled to the markets to expect a rate cut in the near future. It has now become very likely that the deposit rate will be lowered by 0.2 percentage points to -0.60% at the next ECB meeting in September; and the main refinancing rate could drop to -0.20%. The continued path into the negative interest world, however, has quite dramatic consequences."

The Disaster of Negative Interest Policy - Thorsten Polleit"Negative interest rates are just the latest front in the post-2008 era of "extraordinary" monetary policy. They represent a Hail Mary pass from central bankers to stimulate more borrowing and more debt, though there is far more global debt today than in 2007. Stimulus is the assumed goal of all economic policy, both fiscal and monetary. Demand-side stimulus is the mania bequeathed to us by Keynes, or more accurately by his followers. It is the absurd idea, that an economy prospers by consuming and borrowing instead of producing and saving. Negative interest rates turn everything we know about economics upside down."

Negative Interest Rates are the Price We Pay for De-Civilization - Jeff Deist… there cannot be any question of abolishing interest by any institutions, laws, and devices of bank manipulation. He who wants to "abolish" interest will have to induce people to value an apple available in a hundred years no less than a present apple. What can be abolished by laws and decrees is merely the right of the capitalists to receive interest. But such laws would bring about capital consumption and would very soon throw mankind back into the original state of natural poverty. ~ Ludwig von Mises

"Ludwig von Mises understood the importance of interest rates. Interest is like a price ratio, and fixing interest rates is therefore akin to price controls. Given that interest is not just any price, but the price of credit and with that the lifeblood of the economy, it is all the more devastating that its fate is in the hands of central planners.

Since interest rates are of crucial importance for the economy, and in view of the fact that negative interest rates have now been introduced, one question that arises is: how low can they possibly go?"

Negative Interest Rates: How Low Can They Go?

There are no pages beneath this page

There have been no comments yet